Defining Strategic minerals:

Minerals have been essential ingredients for building and advancing civilization for millennia. Recently we examined how minerals are a key input for nearly every aspect of our infrastructure, from homes and office buildings, to roads, bridges, and railways. The built environment around us is such a ubiquitous aspect of modern life that it’s often overlooked in its everyday role helping us meet basic needs like shelter and mobility for economic activity.

In Issue 4 of our newsletter, Explore & Discover, we took a deep dive into the importance and applications of gold. Despite gold’s historical perception as a beautiful and precious status symbol, in today’s world it has incredibly important applications in everything from smart phones, to satellites, to solar panels.

In our last blog article, Minerals are the Future, we highlighted 3 key drivers of change for the natural resources industry and society as a whole: urbanization as a result of industrialization and population growth, technological innovation, and the global-scale challenge of climate change.

Today, these forces of change for modern civilization are fueling the discovery of new uses for an increasing number of minerals. Advances in telecommunications, information technology, health care, energy production, and aerospace have all been possible through the use of new mineral materials. Many of these new products and systems that are built with mineral resources are becoming increasingly integrated in our daily lives and economies around the globe.

Mineral commodities that have important uses in our economy and national security are defined as strategic minerals.

Mineral commodities tracked by U.S.G.S.

Currently the United States Geological Survey (U.S.G.S.) tracks a list of 90 mineral commodities that meet this strategic classification. The U.S.G.S. collects statistics and information on the worldwide supply of, demand for, and flow of minerals and materials essential to the U.S. economy, the national security, and protection of the environment.

Global Production Snapshot

3 REAL-WORLD EXAMPLES OF STRATEGIC MINERALS

Aluminum

KEY INDUSTRIES

TRANSPORTATION

Million Metric Tons Produced (2017)

Million Metric Tons Produced (2017)

Million Metric Tons Produced (2017)

Rare Earths

KEY INDUSTRIES

ELECTRONICS

Metric Tons Produced (2017)

Metric Tons Produced (2017)

Metric Tons Produced (2017)

Titanium

KEY INDUSTRIES

AEROSPACE

Metric Tons Produced (2016)

Metric Tons Produced (2016)

Metric Tons Produced (2016)

What makes strategic minerals critical?

In our previous blog post, we made the case that the global demand for minerals is at a historic high and likely to rise in the future. Due to such trends as the technological innovation boom and the rise of renewable energy, our modernized economy has generated numerous industrial uses for nearly every naturally occurring element known.

The United States can domestically produce some of these resources to meet our own demand, however others must be sourced from different countries around the world. Although most minerals are present in sufficient amounts in the earth to meet demand for the near-term future, their availability isn’t always certain. Risks such as political instability, poor infrastructure, and environmental regulation can disrupt the flow of imported minerals, creating volatility and uncertainty for U.S. markets.

The percentage of a mineral commodity used by the U.S. that must be imported from another country is called net import reliance. In 2016, the United States was 100 percent dependent on foreign sources for 20 of the 90 mineral commodities that USGS tracks.

Mineral commodities that have important uses and no viable substitutes, yet face potential disruption in supply, are defined as critical minerals.

By tracking material flows and global supply data we can understand which of these essential resources is most vulnerable to disruption. A mineral commodity’s importance and the nature of its supply chain can change with time, and therefore ongoing, annual analysis of global supply and demand forces is important. The current administration made this a point of emphasis by issuing an executive order (EO No. 13817) that acknowledges a current list of 35 critical minerals and a strategy to secure and ensure their reliable supply.

Dig deeper on the topic of strategic and critical minerals in Issue No. 3 of Explore & Discover, where Big Rock project geologist Aubrey Lee analyzes the criticality of cobalt.

The Critical State of Cobalt

By Aubrey Lee, Project Geologist

The Global Situation

Global demand for cobalt has dramatically jumped in the last 20 years due to the ubiquity of smart phones and electric vehicles. More than half of the world’s cobalt supply is mined in central Africa in the Democratic Republic of Congo (DRC) – a geopolitically unstable country with poor infrastructure, social unrest, and rampant corruption.

Many companies are wary of using cobalt sourced from DRC and have pushed for more availability of conflict-free cobalt. Most of the world recognizes cobalt as a critical strategic mineral because of these supply issues and the lack of resources in more stable regions.

Cobalt in the U.S.

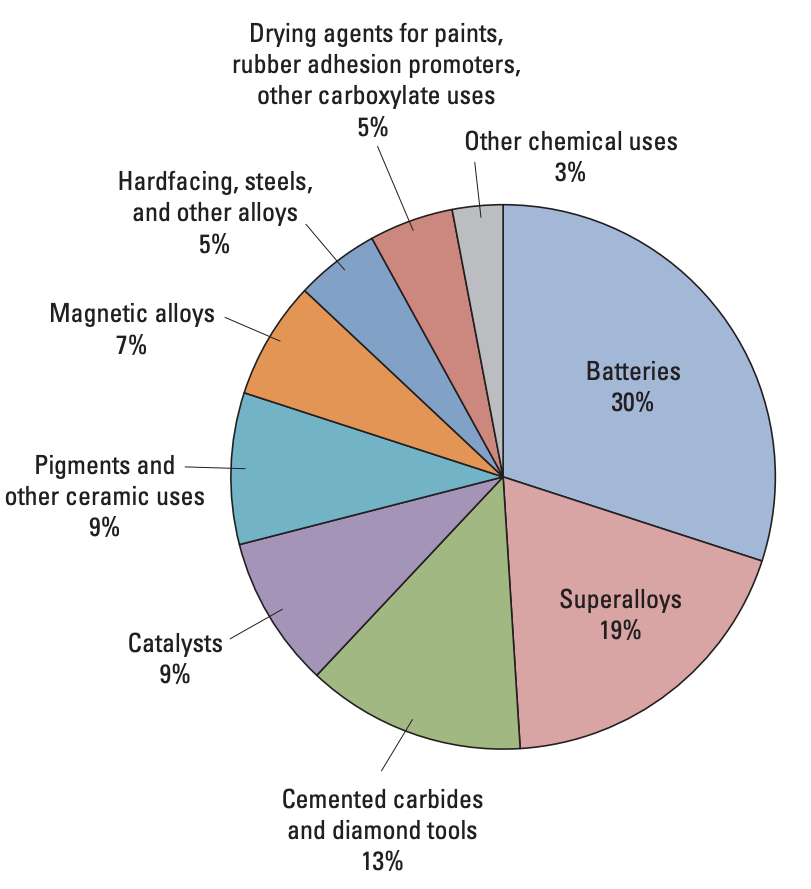

The status of cobalt in the United States is particularly critical. Historically used in steel alloys and pigments, the utility of cobalt has diversified in recent years to optimize the performance of superalloys, cemented carbides, and rechargeable batteries. The metal is essential to the green energy revolution and United States national security.

Today, the US consumes half of its cobalt in the chemical and ceramics industries and the other half in manufacturing superalloys and cemented carbides. Natural resource production of cobalt within the US is dismally scarce and includes only the Stillwater mine in Montana and the Eagle mine in Michigan where it is a by-product of nickel mining (USGS, 2017). In 2016, the US produced only 4.5% of its consumed cobalt, recycled 17.5%, and imported a whopping 78% from other countries. Most of these imports came from refineries in China which source most of their raw cobalt ore from DRC. North American manufacturers are now trying to work with miners for a direct source of the metal to avoid conflict cobalt.

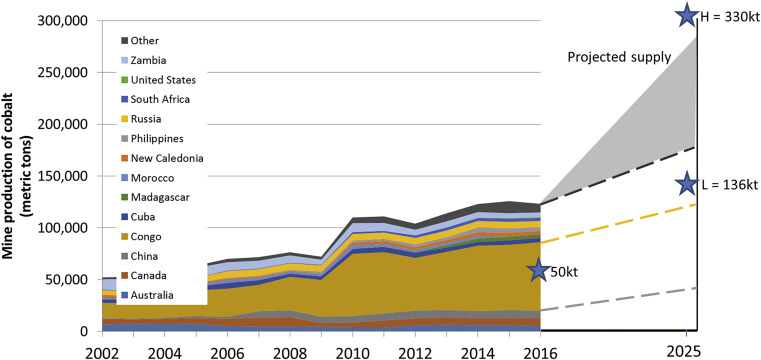

While most producers remained consistent, the world supply of cobalt has fluctuated due to conditions in the Congo and advances in technology.

Figure: Stars indicate global demand and show that supply may not meet demand by 2025. Graph from Joule (2016).

There is also mounting positivity in the mining sector to explore and produce cobalt in North America. Over 0.6 million tons of cobalt lie within Minnesota’s Duluth Complex – a high-tonnage low-grade magmatic nickel-sulfide deposit in the state’s northern arrowhead region (USGS, 2017). Miners have been exploring here for decades and the region is forecasted to be producing in the next few years. Additionally, cobalt resources in Idaho and Ontario are strategically poised to supply North America with conflict-free cobalt for years to come. Finally, with the development of deep-sea mining technology, seafloor nodules and crusts may become a viable resource.

To relieve the U.S. of our dependency on China and DRC for our supply of the critical mineral, innovative solutions for domestic metal resources are crucial. North America must expand awareness of the criticality of cobalt, revive exploration for undiscovered cobalt deposits, and improve mining and recycling techniques to protect our infrastructure, security, and lifestyle.

U.S. Cobalt consumption by industry (2017)

A NEED For Innovative Domestic Solutions

“North America must expand awareness of the criticality of cobalt, revive exploration for undiscovered cobalt deposits, and improve mining and recycling techniques to protect our infrastructure, security, and lifestyle.”

Aubrey Lee, Project Geologist

2020 © Exsolve, Inc.

info@exsolvetech.com